fjrigjwwe9r3SDArtiMast:ArtiCont

bisoprolol

bisoprolol

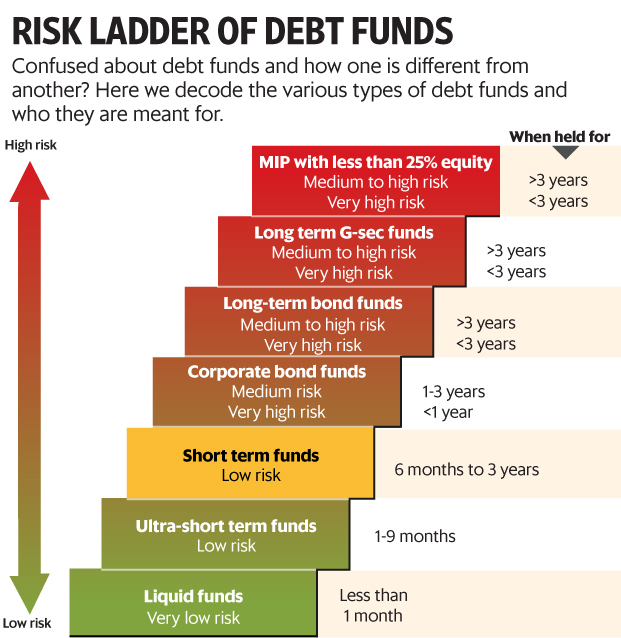

read xt-align: justify;">If liquid and ultra short-term funds can be used to park cash for immediate liquidity and also for slightly longer term than immediate cash needs, then short-term bond funds are meant to earn some sort of regular return, slightly more than your fixed deposit. This is the third debt fund decoder in this series, where we discuss seven broad categories of debt funds.

What is it?

Short-term bond funds invest in debt securities that mature in about a year to three years. They can invest in a mix of short-term instruments like commercial paper, certificates of deposits to medium- and longer term instruments corporate debt scrips and government securities.

Returns and risk

In the absence of any definition or guidelines laid down by the capital market regulator, Securities and Exchange Board of India (Sebi), there are broadly three strategies that short-term bond funds follow. Typically, no two short-term bond funds are alike.

The first strategy is when short-term bond funds try to maximize their gains by investing in higher maturity debt scrips during one time period and then switching to low maturity scrips in another. In a declining interest rate scenario, the fund managers buy longer tenured scrips as when interest rates fall, bond prices move up. For instance, Birla Sun Life Short-Term Opportunities Fund’s average maturity has ranged between 237 days (November 2012) and 5 years, 8 months (March 2016).

To increase their average maturity, some funds increase their exposures to long-dated government securities. Some, though, invest in g-secs to ensure that the portfolio remains liquid since g-secs are the only liquid instruments in an otherwise illiquid debt market. And typically, the most liquid g-sec is the 10-year benchmark security; the presence of which in your debt fund’s portfolios automatically hikes up its average maturity. But how much your fund invests in such long-dated g-secs—and their tenures—will tell you whether its liquidity or a duration strategy that the fund manager is after.

The second popular strategy that some short-term bond funds follow is to take a bit of credit risk. Although these funds invest a significant chunk of their assets in high-quality and AAA-rated securities, they invest a small portion of their portfolios in slightly weaker credit rated scrips, but well-managed companies. Some schemes, especially those from Franklin Templeton Investment India consciously invest a large chunk of their assets in such scrips hoping that when their ratings improve, their scrips’ prices go up and so would the schemes’ net asset values. But this move could backfire if the underlying companies default in interest/principal repayments.

A third strategy is when short-term debt funds maintain their average maturities in a tight range and also limit the credit risk. These strategies are the best for long-term wealth creation as they avoid taking on too much risk and lend some stability in your portfolio, which is what your fixed income allocation is meant for.

What’s so special?

Since short-term debt funds are actively-managed, they are a great tool to maintain your asset allocation. Financial advisors suggest that if you’re in higher tax brackets, use more of short-term funds instead of bank fixed deposits to maintain the fixed income portion of your overall asset allocation.