SBI General Insurance’s Cyber VaultEdge insurance policy provides comprehensive cyber insurance cover for individuals and families, but every benefit comes at a cost.

SBI General Insurance Co Ltd has launched a cyber insurance policy to cover you against cyber losses. This is a growing breed of insurance covers aimed at protecting those who spend a lot of their time online. Let’s take a look at what it offers.

What is it all about?

A cyber insurance policy typically covers losses arising out of thefts from your bank account or wallet, or if someone impersonates you online and withdraws money. A cyber insurance policy also covers you from cyberbullying; this is important for social media influencers who have a large and prolific social media following. Cyber extortion — an act where a criminal takes your computer, systems, and data hostage and releases you only if you pay a ransom — is another common crime against which a cyber insurance policy covers you. And the policy covers the restoration and repair charges as well to get your systems back in shape.

VaultEdge policy covers you against all these losses. If you attempt to sell non-commercial goods over the internet and you are defrauded into, say, paying the buyer money instead of receiving money — you are covered too.

“Anyone who has a bank account is a potential customer of a cyber insurance cover,” says Manoj Kumar AS, Director - Liability and Mumbai Branch Head at Global Insurance Brokers Pvt Ltd.

If you unintentionally say something objectionable on any social media platform and get sued, the policy covers your legal costs and damages.

The policy covers negligence on your part. Obviously, if you indulge in any malicious activities, your losses won’t be covered. Any losses arising out of online gambling or cryptocurrencies will not be covered.

What works?

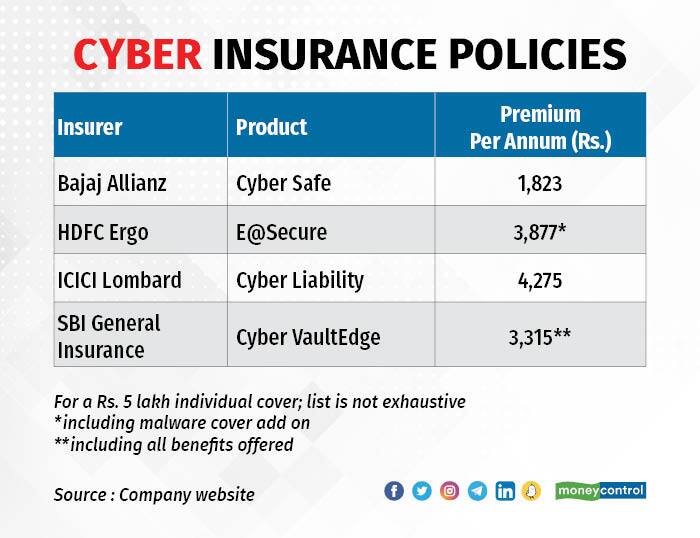

Cyber insurance policies aren’t as popular in India as health and life insurance policies, or even motor insurance policies. But most of us now increasingly spend more time over the internet. For those who indulge in a lot of online shopping, maintain an internet bank account, and use social media platforms, VaultEdge is a good addition to have.

If you use social media a lot or are a social media influencer or a commentator, then this policy covers you against any unintentional damage you may cause due to your opinions. The policy covers your legal fees. And if you need any psychological assistance like counseling to get over a cyberbully attack, the policy covers those costs as well.

Another good inclusion in this policy is any unintentional damage caused by an underage member of your family, such as your child. Kapil Mehta, Co-founder, SecureNow Insurance Broker Pvt Ltd, terms this as an important addition because underage children spend a lot of time on the internet and may not understand the consequences of some of their online behavior. “And very often, their parents have to pay for the consequences,” he says.

What doesn’t?

Insurance policies work well for you if the claims disbursement happens quickly and you get your insured amount back. Mehta says that there isn’t much evidence to show how quickly cyber insurance policies reimburse your sum assured.

Documentation can be lengthy. Typically, cyber policies need a police complaint or a letter from a bank that won’t reimburse you your losses if money gets stolen from your bank account. You need to prove that you’ve lost money; like a bank account or a credit card statement.

Apart from the above-mentioned documents, SBI’s Cyber VaultEdge policy requires you to keep handy the copies of legal notice received from any affected person/entity, copies of summoning received from any court in respect of a suit filed by an affected party/entity, copies of invoices for expenses incurred for the services of a specialist, evidence of consultation with psychologist/psychiatrist, as required under different circumstances.